THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I am not a fan when it comes to car shopping and buying a car.

In fact, many car buyers don’t like the car buying process either.

Car salespeople have a lot of tricks to get you to pay more for a car and its hard to really know what is a fair price, when you are getting a good deal or a bad deal.

This makes it tough to negotiate a car price.

Nonetheless, it was time for us to upgrade to a new minivan.

I was driving a Volkswagen GTI, which I loved, but with a growing family, it just wasn’t cutting it any more.

We started to look at minivans and this is when I decided to use a car buying trick I used twice before to get an incredible deal on buying a car.

Below is our story of the steps we took when buying a minivan, including how we approach car negotiation.

You can follow this complete guide for buying your next car to learn the secret to saving money on a new or used car.

Since we tend to keep our vehicles for 10 years or more, we usually purchase new. In many cases, we end up taking an auto loan out as well.

I know some readers are probably shunning me right now, but taking out an auto loan really isn’t the end of the world.

If you can get an interest rate of less than 3%, it’s essentially free money when you take into account inflation.

And if you pay off the loan early, the interest you do pay is inconsequential.

Plus, dealership financing is a great bargaining tool.

You read that right. You can save money by financing a car!

I’ll get into how this works later in the post.

For now, here is our story for buying a car.

KEY TAKEAWAYS

- The more research you do before planning to buy a car, the better deal you will get

- By negotiating over email, you can avoid many of the pitfalls that come with in-person negotiation

- Using my email template, you can save up to $5,000 on your next vehicle

- If negotiating scares you, there is a no haggle alternative that will get you a fantastic deal every time

How To Negotiate A Car Price

Starting The Car Buying Process

Now that you know what we ended up going with and the reasons why, let’s back up a minute and really start from the beginning.

As you know, we bought a minivan since we have a small family and needed the room.

This is us weighing needs versus wants when it comes to cars, and really is the very first step when buying a car.

You have to know what you need, not what you want.

Personally, I would have rather kept my GTI.

But that is what I wanted, not what we needed.

We needed something that had room for our family and all the things that come with it.

So, the very first thing you have to figure out when thinking about your next car purchase is to know if you really need a car or you just want one.

What do I mean by this?

If your car is running fine and fits your needs, you most likely only want one, you don’t need one.

Here are a few examples to make this clearer.

- If you have a small two-seat roadster and are expecting a child, you need a car.

- If you are lusting over a new model that just came out but your car is not breaking down on you, you want a car.

- If you just finished paying off your current car loan and are considering using this “new” cash to buy a car, you want a car.

If you determine you only want a car, then you don’t really need one and shouldn’t be shopping around in the first place.

But with that said, you can still benefit from this guide as it will help you to save money and make sure you can afford a car when you truly do need one.

The next step in the car buying process is to open a savings account.

You need to do this to either to purchase the car with cash and not take out a loan, or to have a decent down payment so that you don’t have to take out a large loan.

Luckily, saving for a car is fairly straightforward.

Assume a typical monthly payment for a new car is $400 per month.

Go online and set up a savings account with CIT Bank.

Best Bank Account

CIT Bank

With one of the highest paying interest rates in the U.S. CIT Bank stands out as the best high yield savings account. Add in ease of use and great customer service, and you have a clear winner.

We earn a commission if you make a purchase, at no additional cost to you.

You can name it anything you want. We’ll call it ‘Car Fund’.

When you set up this account, you link your checking account that you currently have to the new account.

Then set up an automatic monthly transfer of $400 on whatever day of the month you chose. We will use the 1st of the month.

So, every 1st of the month, $400 is automatically transferred from your checking account into your Car Fund account at CIT Bank.

There are a few reasons you do this.

First is to have the cash to buy without the need for a loan.

Second is to get used to the monthly payment you will have when you buy the vehicle and have a loan.

Third is to be able to put down a sizeable down payment.

If you cannot easily afford to save $400 a month, then you might not be in the position to buy a new car for $30,000 or more.

You might be better off looking at buying a used car, or even a beater car.

If on the other hand you are looking to pay in cash, you should still set up a dedicated savings account.

The only difference is the amount you save each month. The more you are able to save, the sooner you can make your purchase.

In addition to this, you want to review your budget.

Is there or are there any areas where you can cut back so that you can save more into your car fund each month?

Remember you don’t have to go without something forever, just for a short time so you can save for your car.

Lastly, in addition to the tips above, you want to get a free credit report so that you can see if there are any errors that could cost you from getting a great finance rate.

Be sure to also get your credit score as well.

Best Free Credit Score

Credit Sesame

Credit Sesame offers your credit score for free, with no credit card required. Simply provide your email and get started learning your score.

We earn a commission if you make a purchase, at no additional cost to you.

There are some car salespeople out there that will tell you your credit score is lower than it really is.

Know your credit score before you walk in the door.

You should do this even if you plan on paying cash for a car.

The reason for this is because you might get an incentive, like more off the price of the car if you finance it through the dealership.

It’s better to have as much information as possible so you can save the most money.

Now that we know we need a car and have started to save for it, we can start searching for cars and getting one at the right price.

Researching Cars

Depending on who you are, researching new cars can either be a great experience or a dreaded one.

Hopefully the tips below will make this easy for you.

Note that most of the information here works best for buying new cars, not used cars.

While you can still use this guide for used cars, know that the savings won’t be as much as there is a smaller profit margin on a used vehicle.

#1. Do Your Research

Visit car websites to find ones you like.

If you live near a large metropolitan area, see if there is an annual car show.

This way you can see many different types of vehicles without the pressure of car salesmen.

If needed, visit multiple car dealerships on Sunday to look at cars.

They will be closed, but you can still walk the car lot and see the car in person.

You won’t be able to sit in it, but you can at least look it over from the outside to see if you still like it.

I’ve found that many times I like a car online but dislike it in person.

They must photo shop the images or take weird angles to make it look good!

#2. Visit Car Forums

If you simply type the vehicle you are interested in and the word “forum” into a search engine, you are going to find people who own it talking about it.

Here you will find common likes and dislikes, and any issues people might have.

This is a great help because most people don’t notice the little things when first looking at a new vehicle.

Many times these forums will also have a section where people list the car deals they got.

You can use these as a guide to help you determine if you are offered a good price.

Just know that prices vary by region, so you need to understand the location of the car sale to accurately compare it.

#3. Take A Test Drive

Once you think you know what you want, head over for a test drive.

Tell the car salesman you are at the beginning stages of looking for a car and just want to take one for a test drive.

Ninety-nine percent of the time, they won’t pressure you.

Other times, you’ll get the jerk of a salesperson trying to sell you the car.

Do your best to tell him “no thanks” and be on your way.

If he feeds you the line “what would it take for you to buy the car today”, reply as my friend did, say “an act of God” and enjoy the reaction on his face.

His goal is to start negotiating in person, since he can control the deal better this way.

He will play waiting games and walk into the sales office to talk with the sales manager multiple times, just to wear you down.

Don’t fall victim to this and walk away.

#4. Assess Your Needs And Wants

I know we did this already, but it is important to do it again.

Once you fall in love with a car, you start needing all of the features, like leather seats, moon roof, wifi connection, etc.

Take some time to list everything down and then review the list to see what you really need in a car.

The reason for this is simple.

These additional features will increase the car’s price.

But don’t completely forget about the other features.

You might be able to use them in negotiations later as free options or add-ons.

After a week or two, look over the list again.

In fact, you will look over the list going forward on a regular basis.

This is because it will change.

When you start car shopping, you may realize there is a feature that would be great to have but isn’t on your list.

Your list isn’t set in stone. Update as you review it.

#5. Assess All Costs

If you are really set on a model, be sure to weigh costs you aren’t thinking about now.

This is something most car shoppers don’t do and it results in them having higher costs than they were planning.

Things like auto insurance coverage, the cost of gas and maintenance, etc. all come into play here.

I highly suggest your call your insurer and get an accurate car insurance quote for the automobile you are considering.

Better yet, skip the call and use Insurify.

This free tool will get you quotes from multiple insurers at once and let you see who offers the best rates.

Users save on average $500 a year on car insurance.

Get Multiple Insurance Quotes

Insurify

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

You might even want to consider resale value too, but this shouldn’t be the reason you don’t buy the car.

The reason you want to look at these other costs is because they can add up.

If the car you want takes premium gas and gets poor gas mileage, your fuel bill is going to be high if you put a lot of miles on your car every year.

Likewise, if you are driving around a 10 year old car and buy a brand new vehicle, you might get shocked at your new car insurance premium.

Lastly, the cost to repair a car only goes up.

It’s good to know just how much it costs to get maintenance done too.

For example, I didn’t think of this when we bought our last SUV.

When I took it in for an oil change, I almost had a heart attack. Since it takes so much oil, it was $150 for a routine oil change!

All of these costs factor into the vehicle you buy, so don’t ignore them.

Finally, don’t think that an extended warranty will save you money.

Many times you pay more for the coverage than you save on repairs.

#6. Get Qualified For Financing

Assuming you plan to finance the purchase of the car, you should get pre approved financing to ensure you get the best deal.

You can visit your local bank or credit union where you have accounts to see what rate they would charge you.

You’ll want to get financing information from at least two additional sources, like banks or credit unions.

This will help you to better assess which financing options are the best and doesn’t put you in a corner with having to take dealer financing.

At this point, you should have found a model that you want and what features it has that you need.

We can then proceed to negotiate car prices.

But before we do this, I’ll walk you through our experience so you can know what to expect.

My Car Negotiating Process

Here is how we saved thousands using our car buying strategy.

I’ll walk you through each of the steps below, but wanted to tell the whole story so you can see it in action.

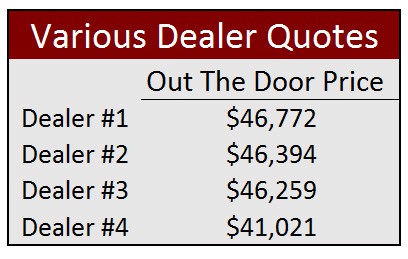

Our first step was to identify multiple dealers that had the minivan we wanted so I could email them.

We ended up with a list of 4, including the one where we test drove the minivan.

To make this easier, I jumped online to the review site Edmunds and began to search for the Pacifica.

I did this so I knew what car dealers to email.

If I just sent out a mass email and they didn’t have the minivan, they might not be able to give me a great deal since they would have to make a trade with another dealership.

After I found a few that had the Pacifica we wanted, I expanded my search out to dealers farther away, including nearby states.

I picked two that had competitive online prices for the Pacifica.

As you will see, it is important to get a car dealer from far away if you want to get a good deal.

Now that I had my list, I wrote out my email.

In the email, we were specific with the make and model of the minivan, as well the colors and options we were looking for.

If the website listed the vehicle identification number (VIN) on the sales page, I included that as well, to be certain we were talking about the actual car I found online.

In the email I told them I was interested in buying the minivan this month and I wanted them to email me back with their best out the door price.

The out the door price is the final price of the minivan, which includes:

- Vehicle’s price

- Sales tax

- Registration fees

- Other fees

Essentially, it was the total price of the minivan.

Having the out the door price is an easy way to get an apples to apples comparison.

If you just get the car’s price, you might choose one dealer only to find their fees are much higher.

The price quotes came back rather quickly.

All of the quotes were in a close price range, however one of the quotes from out of state was a lot lower.

At the time, there were all sorts of rebates being offered on the minivan.

This included a $1,000 rebate if you financed through Chrysler.

Since the promotional interest rate was 0% over 60 months, it made sense to finance the minivan to get an additional $1,000 off the purchase price.

Before I go any further, you need to know the invoice price of the Pacifica for the model year we bought.

It was $43,012.

The new car price according to the sticker price was $49,825.

I was hoping to get something close to this target price and the one out of state quote was below invoice.

I reached back out to the 3 others and told them I had gotten a few quotes and the best one was for $41,021.

I asked if they could beat it.

Two responded right away with a firm no.

But a local dealer asked me to give them a call to discuss it in more detail.

I usually wouldn’t do this, since a phone call is going to take up my time.

But I had a feeling about this, so I called.

The car salesperson was polite and I felt he was credible from the start.

He told me he could not beat the other price quote but could lower his price to $46,000.

He then asked me what dealership the quote was from.

When I told his it was from out of state, he gave me a warning.

He said a lot of times, salespeople will offer you a price with rebates and other discounts you don’t qualify for.

Then when you show up, you find out the real cost of the vehicle.

He then said if I do decide to purchase from the one out of state, to just be careful.

I thanked him for his time and advice and reached out directly to the out of state salesperson.

I wanted to be certain this was the price I was going to get and not a bait and switch situation.

The salesman assured me that was my price and that I qualified for all the discounts and rebates.

He then told me that since they sell such a high volume of automobiles, they get kickbacks from Chrysler for hitting sales goals.

This is the main reason they were able to offer a price much lower than others.

The kickbacks more than make up for selling a few cars for a small loss every month.

After thinking about it and talking it over with my wife, we decided to move forward with the out of state offer.

I was sure to take into account my opportunity cost, since I would be losing a day of travel to get the minivan and return home.

I left late afternoon the next day, took a train to my sister’s house, spent the night and took an Uber over to the dealer the next morning.

Final Negotiations

When I arrived, we looked over the minivan and drove around a little to make sure it ran smoothly.

Then came time to meet with the finance manager.

He tried to get me to buy additional extended warranties and protection for the car, but I passed.

I finished signing the paperwork and was home later that afternoon.

Our Savings

In the end, we bought a brand new Pacifica for roughly $2,000 under invoice.

Based on the sticker price of the car, we saved close to $9,000!

Since all the other offers were for $3,000 over invoice, I feel like we did great and this proved that my strategy for how to negotiate a car worked.

How To Negotiate Car Price Over Email

Here is a step-by-step plan for car negotiation success.

I’ve done this three times now, first for myself when I bought my car, saving myself $3,000.

Then again for my wife with her SUV, saving us $5,000.

And now finally for our minivan.

Each time, it has resulted in a car purchase for a few thousand below invoice.

At this point, I will assume you know what car model you want.

If you don’t, follow the steps I outlined earlier and them come back to this section when you are ready to negotiate.

A quick side note, if you hate the idea of car negotiating, check out Edmunds New Car Quotes.

It is a completely free negotiation tool to use and there is no negotiating prices.

You always get a great deal. I talk more about this near the end of this post.

Step #1. Figure Out The Invoice Price

Your first step in the negotiating process is to figure out what the invoice of the vehicle is that you want.

Thanks to the internet, you can easily do this.

Visit online car guides like using Edmunds suggested price or Kelley Blue Book to get this price.

You’ll need this number shortly.

Step #2. Research Car Prices

After completing the above step, get an idea for what the typical purchase price is in your area.

Prices vary by location, so knowing the average price others paid will help you.

Whatever you do, don’t base your decisions off the manufacturer’s suggested retail price (MSRP).

You want to focus more on invoice prices.

Just remember that the average price can be impacted by some people paying a much higher or lower price than others.

At the end of the day, having this number and the invoice price will give you a target price to aim for.

You will also know what a fair price is for the vehicle you are looking at.

Step #3. Consider Vehicle Rebates

Many car manufacturers offer rebates and incentives to help sell vehicles.

Don’t make the mistake of letting a salesperson trick you into thinking they eat these rebates.

The manufacturer will pay the rebate back to the dealership, so there is no financial loss on their end.

Also, be aware of the financing options.

You might be able to get a promotion interest rate or cash off the sales price by financing with the manufacturer.

This all should come into play when deciding on the final price you are willing to pay.

Step #4. Find The Vehicle You Want For Sale

Finally, do a search to find the vehicle you want, with the features you want, at some local dealers.

I would say pick four max.

Choose a few close by and then one that is a few hours away.

I’ll explain why this is key for negotiating in a minute.

Find the internet sales managers contact info and contact the dealerships via email on your list.

Sometimes you will have to send a general email, which is OK.

Use this car negotiation email template I’ve used for all my car purchases with great success (feel free to copy/paste and edit. Just replace the uppercase text with your information):

Hello NAME,

I am emailing you because I am interested in a INSERT VEHICLE (BE SPECIFIC AND INCLUDE YEAR AND VIN # IF LISTED). Here are the features I want:

LIST FEATURE HERE

LIST FEATURE HERE

LIST FEATURE HERE

LIST FEATURE HEREI am looking to purchase the vehicle this month. Please email back with your best price out the door (including taxes and fees) by (SET SPECIFIC TIME).

Thank You,

YOUR NAME

Then sit back and wait for the replies.

Step #5. Negotiate

After getting responses, it is time to negotiate.

If some have not replied by your deadline, email them back letting them know you have a few other quotes and you need theirs as soon as possible.

It’s good to have a spreadsheet open to keep track of all the quotes.

For the quotes that are higher than others, reply to their email and let them know what others are quoting for the car.

Ask them to beat it.

Some will, others won’t.

If they did beat it, email the original best price with the new low quote and ask them to beat it.

Once you do this, you should be close to invoice or slightly under.

Remember to review all of the options for the vehicle you are looking at so you are comparing apples-to-apples.

Step #6. Low Ball

At this point, you should be close to finishing up the process.

But you can use this trick to try to get a good deal.

Once you have your prices, email the dealer that is a few hours away.

Again, feel free to copy/paste/edit this email:

Hello NAME,

Thank you for taking the time to provide me with a quote. I appreciate the time you took to offer it to me, however, the price you quoted isn’t low enough for me to make the trip to purchase the vehicle.

Again, I thank you for your time.

Thank You,

YOUR NAME

Leave the ball in their court.

Many times, they will come back and ask you to name a price.

When they do, low ball them, but don’t insult them.

Look at Edmunds again and see what the going price is.

I like to take $2,000 off of this price.

They might not match the price, but they should meet you somewhere in the middle.

Then email this quote to the others and have them beat it.

Either they beat it, they match it, or they say no thanks.

Step #7. Accept Offer

Whoever ended up with the best price and you feel comfortable with, pick them and complete the transaction.

Be sure to reply to the other ones you emailed, letting them know you are buying the car from another dealer and thank them for their time.

Once in a while, one of them might come back with a lower offer to try to win your business.

It is your call as to how you handle this.

Personally, I like to be honest and fair, so I limit the negotiating to three rounds:

- Round #1: Sales managers name their price

- Round #2: I counter-offer with other quotes

- Round #3: My final offer to the one I want to buy from with the lowest quote

You could drag this on longer, but many salespeople will get tired of this and think you are not a serious buyer.

With that said, there is nothing stopping you from doing this or even agreeing to buy from one salesman and then back out if another offers an amazing deal.

At the end of the day, you have to make the best financial moves for you and your family.

Finally, be sure to take into account any dealer add-ons here.

You might be able to get them to throw in some free options if they really want the sale.

Just don’t ask for every option available.

Run through your list of options and see if there is one or two you could ask for.

How To Get The Best Car Deal

Before you begin to haggle car prices, here are some car buying negotiating tips to keep in mind before you start to help ensure you get the best price possible.

#1. Understand Out Of State Buying

If you are seriously considering buying out of state, make sure you understand the fees associated with doing so.

In my case, the fees would have totaled close to $500 plus the cost of the commute with one of the offers.

It wasn’t worth it, even though they offered me a competitive price.

#2. Determine What You Are Doing With Your Old Car

I use Edmunds or Kelley Blue Book to see what my car is worth. You could even use NADA.

They will provide private party prices, which is the amount I can expect if I sell the car on my own.

They will also provide the trade in value, which is the amount the dealer will offer if I sell to them.

These numbers will determine what you should do.

If you decide to trade it in, don’t discuss this until after you come to a price on the new car.

This is critical when you negotiate car prices.

When you begin shopping for a car, the salesman will ask if you are trading in your vehicle before offering you a quote on the new car.

Simply tell them you are undecided on what you are going to do.

Once you agree on a price for the new car, then tell the car salesperson you want to trade in your old car.

Be ready for them to low ball you here.

They will point out everything that is wrong with your car. You know how much you should be getting for the car so stick to that price.

Granted they will never offer you the private party price, but you should get around or more than the trade in price.

#3. Be Smart With The Finance Manager

Decline everything they offer, including the extended warranty.

It isn’t worth the cost.

Don’t be mean about it, just politely decline.

This can be hard if you opt for the car that is a few hours away.

They know the odds of you leaving without buying the car is slim, so they will really pressure you on the extras.

Just stand your ground and don’t give in.

#4. Understand The Financing

If there are deals that are available when you finance through the manufacturer, consider them.

You don’t have to carry a car loan for the full term.

If you have the cash to buy the car outright but get $1,000 more off if you finance through the manufacturer, then finance it.

It costs you nothing if you then use your cash to pay the loan off in the first month if you don’t want to have monthly payments.

Sometimes a good deal is contingent on financing.

Never show your card that you plan to pay the loan off immediately.

The less information the salesperson has on you, the better.

#5. Get A Discount When You Pay Cash

On the other hand, if you do have the cash, consider using this as a negotiating tool.

Some dealerships might offer you a substantial discount if you pay cash as opposed to financing.

But since more and more dealers make the bulk of their money by signing people up for dealer financing, deals when paying cash are harder to come by.

#6. Read And Review Paperwork Before Signing

It may sound like legalese, but it’s important to read what you are getting yourself into.

At the very least, you need to review the sales agreement to verify the prices listed are what you initially agreed to and that there are no new fees included.

You never want to assume the car dealership is right.

They usually have someone else type up the paperwork and you need to make sure it is correct.

I highly suggest you print out the email with the quoted price or have access to it on your phone.

Under no circumstance should you pay for prep fees or documentation fees.

#7. Always Remember You Are In Control

Car negotiation can be very stressful and salespeople are good at breaking you down, especially if you do it in person.

If you do this, make sure you eat before going and bring some snacks.

Also remember that you hold the power.

You don’t have to buy the car. You can walk away and you should if you don’t get the deal you want.

There are multiple dealerships and this isn’t the only car available.

If you are willing to walk away, you should be able to get your price in the car negotiation process.

#8. Understand Every Deal Is Different

I laid out the basic blueprint for car negotiation.

But don’t think this is set in stone.

Every negotiation I’ve done is a little different.

When we bought my wife’s SUV, we ended up picking a local dealer that quoted a higher price.

There were two reasons we did this.

First was because of the added fees from the out of state dealer made the two offers closer in price.

And second, the local salesman was going to throw in the upgraded entertainment system and blind spot monitoring at no cost.

When we took into account the free options, it was an easy choice.

Then when I was making a deal for the Pacifica, the out of state dealer offered such a great price, I didn’t add additional negotiating rounds.

The bottom line is, use this information as a guide and be willing to do things a little differently to get the best deal.

The No Haggle Alternative

Finally, I want to talk to those car buyers who have gotten this far and are in the market for a new car purchase but hate negotiating.

Many people are in the same boat and even though negotiating prices is the best way to save the most, people won’t do it for various reasons.

Luckily, you can still get an incredible deal on a new car.

All you have to do is head over to Edmunds and use their New Car Quotes feature.

With this, you fill out what car you are looking for, your zip code along with your name, phone number and email address.

Once you click submit, you will receive a special price at a local car dealership.

All that is left for you to do is go to there and close the deal.

While you could potentially negotiate an even better price, the New Car Quotes comes in at or below the Edmunds True Market Value the majority of the time.

In other words, you can be confident you are getting a fair deal.

Frequently Asked Questions

The process of buying a car can feel overwhelming because of the large amount of money you are dealing with and because of the horror stories you have probably heard.

Here are some common questions answered to help you feel more confident when you go to purchase your next vehicle.

How much should you offer when negotiating a car price?

How much will a dealership come down on a used car?

How to negotiate a factory order car?

Getting a deal on a factory order car is going to be more difficult than for a car on the dealer’s lot.

This is for two reasons.

First, since it is a factory order, odds are you are customizing it to be exactly what you want.

This means there is a low probability that other dealers will have the same configuration on their lot.

And without any dealer to negotiated against, you will have a harder time saving a lot of money.

Also, you might have to place a factory order for a car that is a new release or is so popular that dealers cannot keep them in inventory.

In this case, it will be hard to haggle the car price as there are many buyers looking to purchase, so the dealer will play hardball knowing they don’t have to offer large discounts.

How to get the best deal on a used car?

Regardless if you are buying a new or used car, the process to getting a deal is the same as I outlined above.

Figure out the vehicle you want, find dealers with it for sale, and then reach out over email to start the negotiation process.

How do I negotiate a car price when paying cash?

The best strategy to take when paying in cash is to not reveal how you plan to pay for the vehicle until after you do most of the negotiating.

Once you get to the number you want to pay, or close to it, ask the salesperson how much of a discount they would give if you pay in cash.

The reason you wait is because some dealers offer better deals when financing the vehicle.

By leaving the door open, you can potentially get a better deal than if you started the negotiations saying you will pay with cash.

Can you negotiate the price when buying a Tesla?

You cannot negotiate the price of a Tesla.

Everyone pays the MSRP or manufacturers suggested retail price.

This is good news if you don’t enjoy haggling, but not great if you are looking to save money.

In order to get a deal on a Tesla, you will have to purchase a used one.

Final Thoughts

If you follow the steps for how to negotiate a car price I laid out for you, you will get a great deal on your next car.

The only trick is that you have to be willing to walk away.

If you can’t walk away from the deal, you are going to pay more than you should.

There are many other cars out there and many other deals.

If this deal falls through, it’s not the end of the world.

Be smart and be patient and you will get a great deal on your next car.