Huntington Bank has a comprehensive lineup of business bank accounts. These include three checking accounts tailored to the needs of small and midsize enterprises, three feature-rich business savings accounts, an array of business credit products, and powerful value-added online banking capabilities housed in Huntington’s Hub for Business.

If you’re looking for a new business banking partner, Huntington Bank (member FDIC) deserves a closer look. Read on for an overview of its account options, features, capabilities, and overall suitability for business users.

Huntington Bank Business Checking Accounts

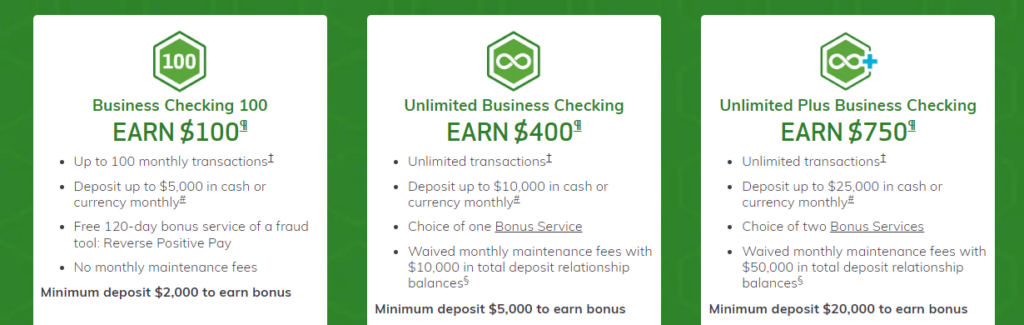

Huntington Bank’s three business checking accounts cater to distinct business users:

- Huntington Business Checking 100 is ideal for smaller businesses and startups with lower transaction volumes and less complicated financial needs overall.

- Huntington Unlimited Business Checking works well for growing businesses that have higher checking activity and greater cash flow needs.

- Huntington Unlimited Plus Business Checking appeals to larger businesses with even higher monthly transaction volumes and more complicated treasury management requirements.

Business Checking 100

Huntington Business Checking 100 is Huntington Bank’s monthly-fee-free business checking account option. Its most notable features and capabilities include:

- 100 monthly transactions

- Deposit up to $5,000 in cash or currency monthly in-branch or at an ATM

- Free 120-day trial of fraud mitigation tool Reverse Positive Pay

- No monthly maintenance fee or minimum balance requirement

Plus, for a limited time, you can earn a $100 bonus when you open a Huntington Bank Business Checking 100 account and complete qualifying activities. Just do the following:

- Open a new Business Checking 100 account before Feb. 5, 2023.

- Make cumulative new money deposits of at least $2,000 within 60 days of account opening.

- Keep your account open for a minimum of 90 days.

Complete these qualifying activities and you should receive your $100 bonus in your account within 14 business days.

Unlimited Business Checking

Huntington Unlimited Business Checking has a $20 monthly maintenance fee. You can waive this fee in any statement cycle with $10,000 in combined deposit relationship balances.

Huntington Unlimited Business Checking has some additional features and capabilities worth noting:

- Unlimited transactions and up to $10,000 in cash or currency deposits monthly in-branch or at an ATM at no charge; $0.30 fee for each $100 after

- Your choice of one additional bonus service, such as two incoming domestic wire transfers per month

Plus, through Feb. 5, 2023, you can earn a $400 bonus when you open a new Huntington Bank Unlimited Business Checking account and complete qualifying activities. Just do the following:

- Open a new Unlimited Business Checking account before Feb. 5, 2023.

- Make cumulative new money deposits of at least $5,000 within 60 days of account opening.

- Keep your account open for a minimum of 90 days.

After completing these qualifying activities, you should receive your $400 bonus in your account within 14 business days.

Unlimited Plus Business Checking

Huntington Unlimited Plus Business Checking has a $40 monthly maintenance fee. You can waive this fee in any statement cycle with $50,000 in combined deposit relationship balances.

Huntington Unlimited Plus Business Checking has some additional features and capabilities worth noting:

- Unlimited transactions and up to $25,000 in cash or currency deposits monthly in-branch or at an ATM at no charge; $0.30 fee for each $100 after

- Your choice of two additional bonus services, such as up to 25 returned deposit items per month and two free incoming domestic wires

Plus, through Feb. 5, 2023, you can earn a $750 bonus when you open a new Huntington Bank Unlimited Plus Business Checking account and do the following:

- Open a new Unlimited Plus Business Checking account before Feb. 5, 2023.

- Make cumulative new money deposits of at least $20,000 within 60 days of account opening.

- Keep your account open for a minimum of 90 days.

After completing these qualifying activities, you should receive your $750 bonus in your account within 14 business days.

Other Huntington Bank Business Products and Features

Huntington Bank’s business vertical is more than the sum of its three checking accounts. The bank also markets three competitive business savings products, several business credit products, and an impressive array of Business Hub tools that every Huntington Bank business account holder can use at no additional cost.

Business Savings Accounts

Huntington Bank offers:

- A business money market account that earns interest

- A savings account for business users

- Business certificates of deposit (CDs)

Business Premier Plus Money Market Account

The Business Premier Plus Money Market Account is an interest-bearing money market account that comes with a free debit card (the Huntington Debit MasterCard® BusinessCard®). You can order cards with full or limited functionality for as many authorized employees as you like.

This account has a $10 monthly service fee. To waive the fee, simply maintain an average savings balance of $10,000 or more. And to earn a higher interest rate, open a qualifying Huntington Bank business checking account.

Business Premier Savings

The Business Premier Savings Account is designed for businesses with less than $10,000 in savings. Balances don’t earn interest, but on the bright side, it’s easy to waive the $4 monthly service fee with an average balance of $300 or more.

Business CD

Huntington Bank’s business CD is an interest-bearing deposit account with no monthly service fee. Early withdrawals may incur a penalty; see terms for details.

Business Credit Products

Huntington Bank has a business rewards credit card with no annual fee, plus several types of business loans:

- Real estate loans

- Term loans

- SBA-guaranteed loans

- Specialty practice loans (dental and vet practice loans)

- Business lines of credit

For more about Huntington’s business loans and lines of credit, speak with a Huntington loan officer or visit your local branch.

Voice Business Credit CardSM

The Voice Business Credit Card is a small-business cash-back credit card with a flexible rewards program. Choose one out of 10 categories where you’ll earn 4% cash back on up to $7,000 in eligible purchases each quarter. That’s up to $28,000 in eligible purchases each year. Choose the category that best fits your business’s spending needs:

- Gas stations

- Restaurants

- Travel and entertainment

- Discount and warehouse stores

- Grocery stores

- Utilities and office supply stores

- Electronics, camera, and computer stores

- Department, apparel, and sporting goods stores

- Home improvement stores

- Auto parts and service stores

Plus, you’ll earn 1% cash back on all other eligible purchases. You can redeem for cash, gift cards, travel, merchandise, and more at Huntington’s rewards portal.

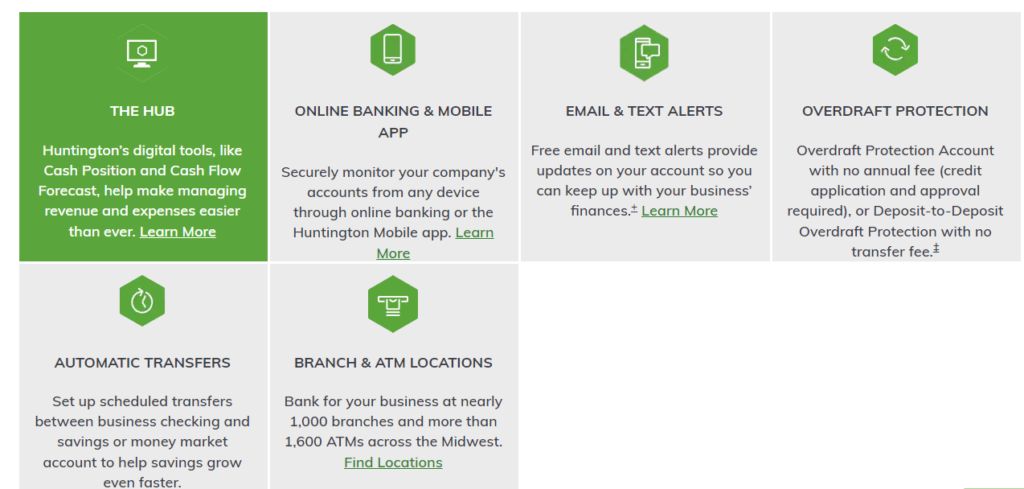

Additional Features of Huntington Bank Business (Hub for Business)

Huntington Bank offers some important additional features and capabilities through its Hub for Business. These include:

- Spend Analysis. This tool helps you categorize past spending. It provides visibility into how your spending is distributed across different areas of your budget. That makes it easier for you to identify potential areas of overspending or opportunities to make new investments in your business.

- Look Ahead Calendar. This tool gives you an overview of future business expenses and income. It’s designed to help organize inflows and outflows before they actually occur and simplify budgeting projections.

- Cash Position and Cash Flow Forecast. These tools offer another angle on your cash flows, providing visibility into where you’re spending too much and where you might have opportunities to boost spending.

Plus, all Huntington business bank accounts come with overdraft protection featuring 24-hour grace. This feature ensures you’re not charged an overdraft protection fee if you correct a negative balance within 24 hours.

See the screenshot below for more details on key Huntington Bank Business features.

Advantages of Huntington Bank Business Checking

Huntington Bank’s business clients enjoy some key advantages here. The most notable are its attractive account opening bonus opportunities for new checking customers, the capabilities of the Voice Business Credit CardSM, and the powerful cash flow and spend tracking tools available to all business users.

- Attractive Account Opening Bonus Opportunities for New Checking Customers. New Huntington Bank business checking customers can earn up to $750 bonus cash when they open an eligible new account and complete qualifying activities. The highest bonus amount is available to new Unlimited Business Plus Checking customers who make at least $20,000 in qualifying deposits during the qualification period.

- No Monthly Maintenance Fee on Business Checking 100. The Business Checking 100 account has no monthly maintenance fee. That makes it ideal for startups and smaller businesses (including single-member businesses) with lower transaction requirements.

- Earn Interest on Balances in the Business Premier Plus Money Market Account. Balances held in your Business Premier Plus Money Market account earn interest. That’s a nice incentive to hold reserve cash — funds your business doesn’t need right away — in this account rather than a checking account that doesn’t earn interest.

- Powerful Cash Flow and Spend Tracking Tools. Huntington Banks Hub for Business (Business Hub) makes some potentially powerful financial tools available to business customers at no additional charge. Use Spend Analysis to categorize and track past spending, Cash Flow Forecast to predict future cash flows, and the Look Ahead Calendar to plan future investments in your enterprise.

- Business Rewards Credit Card With No Annual Fee. The Voice Business Credit CardSM has an unusually generous and flexible rewards program that’s easy to fit to your business needs. Even better, it has no annual fee, so you won’t have to pay a recurring charge simply for keeping your account active.

- 24-Hour Grace on Overdrafts. Huntington Bank’s 24-hour grace feature ensures you’re not charged an overdraft fee when you correct an eligible negative balance in your Huntington account within the 24-hour grace period.

Disadvantages of Huntington Bank Business Checking

No financial institution is perfect. Huntington Bank falls short on the tough monthly fee waivers for its Unlimited and Unlimited Plus checking accounts and the high deposit requirement for the Unlimited Plus account’s new member bonus opportunity.

- Strict Monthly Fee Waivers for Unlimited and Unlimited Plus Business Checking. Huntington Bank’s Unlimited and Unlimited Plus Business Checking accounts come with monthly maintenance fees by default. You can get these fees waived with qualifying activities, but the requirements could be challenging for some businesses.

- High Initial Deposit Requirement for the Unlimited Plus Business Checking Bonus. The Unlimited Plus Business Checking bonus requires a cumulative initial deposit of $20,000 or more during the qualification period. Depending on your company’s margins and cash flow situation, this could be a difficult threshold to clear.

How Huntington Bank Stacks Up

Not sure Huntington Bank is right for your business? See how it stacks up against another popular business bank: Chase for Business.

| Huntington Bank | Chase Bank | |

| Account Opening Bonus | Up to $750 | Up to $300 |

| Monthly Maintenance Fees | $0 to $40 | $15 to $95 |

| Fee Waiver Reqs | Strict | Strict |

| Business Credit Cards | One | Four, plus co-brands |

Is Huntington Bank Legit for Business Owners?

Yes, Huntington Bank is legit. If you haven’t heard of it, it’s probably because you don’t live in an area where Huntington has branches. It’s a dominant bank across the Midwest and Ohio Valley regions, with more than 1,000 branches and tens of thousands of fee-free ATMs.

Huntington Bank isn’t always the best bank for business users. In fact, it has some significant downsides, as we’ve explored. But it’s not a scam. Millions of people have good things to say about Huntington.

Final Word

Huntington Bank’s business vertical has the potential to be a fantastic partner as your enterprise grows. Its products and services include:

- Three checking accounts each tailored to the needs of a particular business user, including a maintenance-fee-free business checking account for startups and small companies.

- Three savings options, including a money market account that pays interest on reserve cash you don’t need right now.

- Several business credit products, including a business credit card with flexible rewards and no annual fee.

- Powerful cash forecasting and spend tracking tools.

If any of this sounds like a good fit for your business, you’re ready to take the next step and learn more about Huntington Bank.