THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

When it comes to money and improving your finances, where do you start?

Most people answer this question by talking about investing or how to make extra money on the side.

This makes sense since these are the more exciting aspects of money.

But in order to build wealth, you need to focus on the foundation first.

When it comes to your money, your foundation is your budget.

By creating and following a budget, you know where your money is going and have more control over it.

But where do you start with budgeting?

The best and easiest option is free budget templates.

While you could learn how to make a budget in Excel, the truth is you need to have an idea of how the software program works.

And you need a considerable amount of time to build it.

When you choose to go with free templates instead, you save time by not having to build a complete budget from scratch.

And with so many options out there, you are guaranteed to find the right budget template for you, whether it be a digital budget template or a spreadsheet template.

The bad news though is when you first start out searching for free budgets templates, you might become overwhelmed at the sheer number of choices.

This is where this post comes into play.

I’m highlighting 17 of the best free budget templates out there for you.

There are some that are Excel spreadsheet templates and others that are online apps that allow you to budget digitally.

In some cases, there are basic versions of the budget that don’t cost any money and you can pay for an upgraded version.

By the end of the post, you will have an idea of the best budget template for you and your situation.

17 Best Free Budget Templates You Need To Consider

What Is A Budget Template?

A budget template is an organized way to keep track of your income and expenses.

When it comes to setting up a budget, you have many choices.

You can create your own with a pencil and paper, you can create an Excel spreadsheet, or you can use an online template.

No matter what you choose, any budget will follow the same basic principles of organizing your spending in a way so that you are mindful of how and where you are spending your money.

The end result is you will stop overspending each month and will begin to build wealth.

How Do Budget Templates Work?

As I touched on above, budget templates work by looking at your various sources of income and subtracting out your spending.

The goal is to get a zero balance. This tells you that all of your income has been accounted for.

This doesn’t mean you will have nothing left in your checking account.

It simply means that the income you earned was used to pay your bills and save some money.

If you want to have a cushion in your checking account, you could opt to have your budget have a positive ending number.

This is what would be left over in your account at month end.

For example, if you earned $2,000 and have $1,800 accounted for in your budget, you should end the month with an extra $200 in your account.

At all costs, you don’t want your budget to show a negative balance. This means you are spending more than you are earning.

To avoid this, you will have to edit your planned spending so that your budget works out.

This can be difficult for some, as your income may be low or you have too many expenses.

In either case, you need to take action to correct this problem.

If you don’t, you are just digging yourself a deeper financial hole every month that is going to get harder and harder to get out of.

Printable Budget Templates

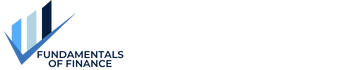

#1. Money Smart Guides Spreadsheet Template 1.0

OK, this is a shameless plug here.

This is the first budget I used, so I thought it would make sense to offer it up to my readers.

It is a simple worksheet and great for someone just starting out looking for a monthly expenses template.

You just plug in your budget categories in the first column and the amount you plan to spend in each category in the second column.

Then you enter in the amount you actually spent in the third column and viola!, you see where you need to cut back on spending.

This monthly expenses template makes tracking the areas you are overspending in easy by grouping categories together for simplicity.

You can download this budget here.

#2. Money Smart Guides Spreadsheet Template 2.0

I’m all about the shameless promotion today!

Here is the second budget I used. It’s a modified version of the one above.

I created this one because it has a much cleaner look to it and after getting married, I wanted a more detailed family budget telling us where our money was going.

My favorite part is I added a savings section to this Excel budget planner.

By including this I can see the percent of my income I save every year and I can see that amount broken out into the various savings accounts I am using.

You can access this personal budget here.

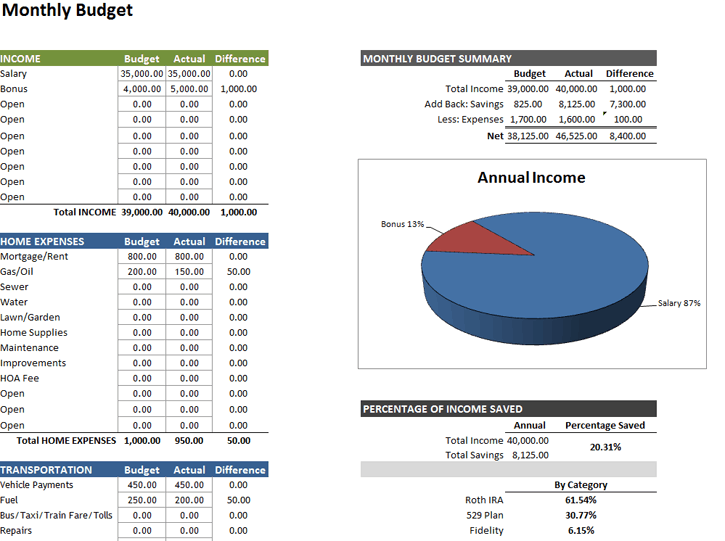

#3. Budgets Are Sexy Budget Template

J$ over at Budgets Are Sexy has a great Excel spreadsheet budget download for you to use as well.

This one is cool because it works as a home budget spreadsheet.

So if you have multiple sources of income, you can earmark one to pay the mortgage and other bills and the other paycheck can be used for savings.

It is set up in a similar fashion to my first budget template I mentioned, just with more options for better control of your money.

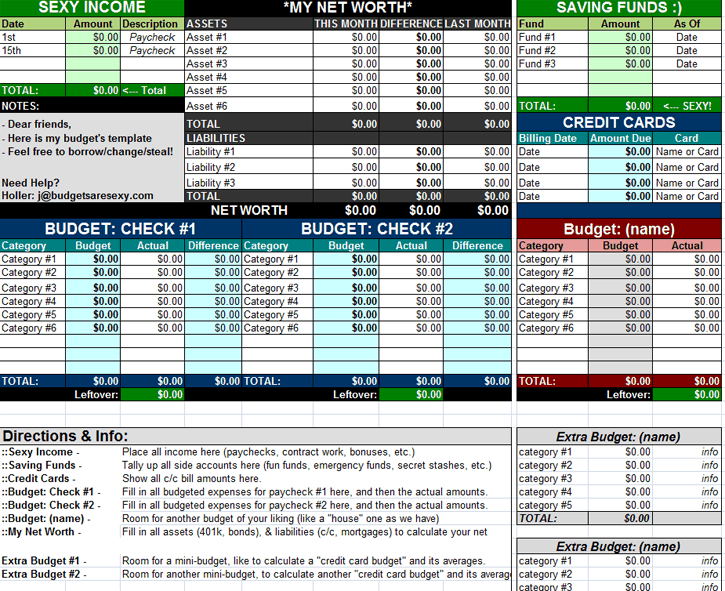

#4. The 4 Step Budget Template

This budgeting spreadsheet can be found on Life After College.

What’s nice about this one is that after you fill in your income, and important expenses, it gives you your allowance to spend on discretionary items.

In other words, you make sure you are covering all of your necessary expenses before you spend money on your non-essentials, making it a great household budget template.

This is ideal because too many people have confused wants with needs.

This budget makes spending clear again so you can get ahead financially.

#5. Kakeibo Template

Kakeibo is an ancient budgeting method from Japan that works incredibly well.

The main difference with this option is that in order for you to use it, you need to physically write out your budget.

There is no Kakeibo Excel template to use.

Granted if you look hard enough online you can probably find a Kakeibo spreadsheet online, but that goes against the core idea of this budget.

The reason you need to manually write everything down is because this forces you to really think about your spending.

And when you are more aware of your spending, you will spend less and save more.

The make it work, you assign your spending into one of four pillar categories:

- Needs

- Wants

- Culture

- Unexpected

Then at the end of the month, you need to answer four questions about your finances.

- How much money do you have?

- How much money are you spending?

- How much money would you like to save?

- How can you improve?

By following these guidelines, you are more aware of your spending habits and can make positive changes to reach your financial goals.

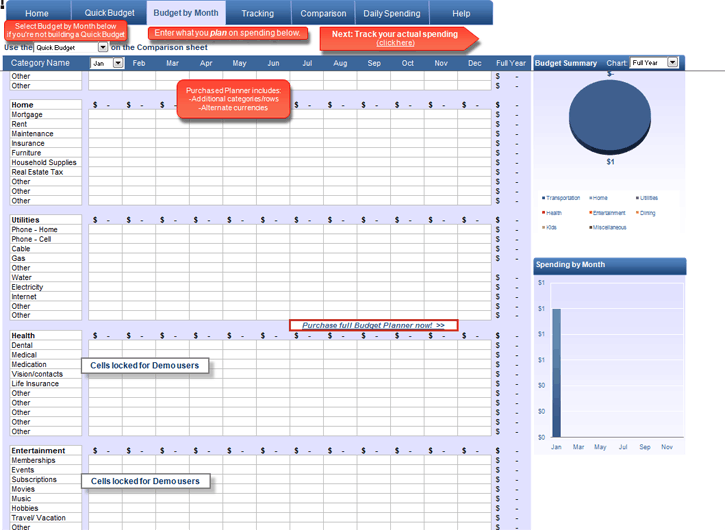

#6. Budget Planner Spreadsheet Template

Of all of the templates I am suggesting, this is the only one that costs money. There is no free version of it.

The one time purchase price is $15.95 which might sound crazy for an Excel spreadsheet template, but this one is really cool.

First, you have a daily spending tab that allows you to insert your spending by category every day.

This information is then linked to the rest of the budget to auto-fill.

While you don’t have to use this feature, it makes sense to.

From there, there is a comparison tab that looks at your budget versus how you are spending up to this point in the month.

This lets you see a “real-time” snapshot of where you might be getting into trouble.

You also have a tab that looks at your budget on a month to month basis so you can see the year in total.

Lastly, the budget allows you to specify the frequency of the budget categories.

So, if you pay your car insurance semi-annually, you can set this category up for semi-annual and the spreadsheet does the rest.

I wouldn’t normally suggest paying for an spreadsheet download, but this one is worth consideration.

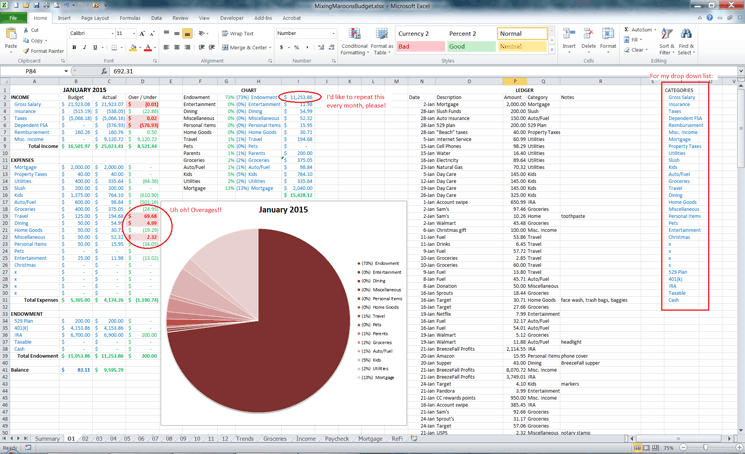

#7. Mixing Maroons Budget Template

Mrs. Maroon recently posted how much she is an Excel geek, and I loved reading every last word.

She created this in-depth free household budget template from scratch and being a fellow Excel nerd, had to check it out.

It is definitely amazing.

For some it might be overkill, but I still recommend it as you can just use the parts that make sense now.

In time, when you want to track more things, you can keep using the same template, since it has the added features.

So why is this budget great?

It is broken down monthly and has a summary page to see everything in one snapshot.

From there, you can track your income, net worth, and even review your spending in detail.

For example, how much did you spend on fruit at the grocery store last month?

That is how detailed you can get.

It even has a mortgage amortization sheet too!

Sadly the site has since gone offline, but I was able to download a copy of the budget, which you can access here.

#8. Vertex 42 Excel Spreadsheet Template

Vertex42 has a ton of budget templates.

Too many to list here in fact.

I’m certain they have one to fit your needs.

Their Excel spreadsheet downloads are free as well. They look great and are super easy to use.

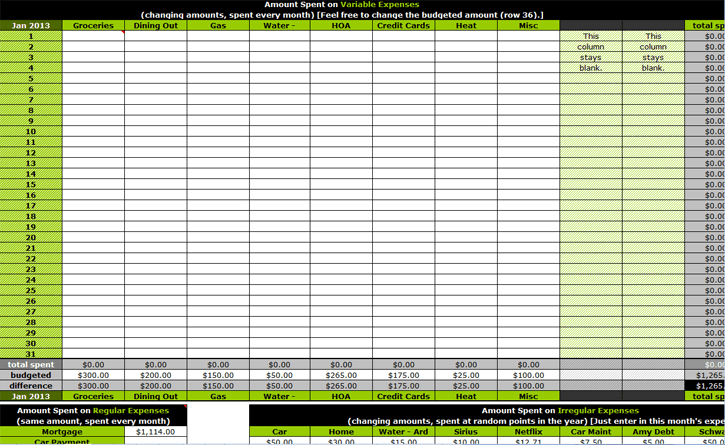

#9. Pear Budget Spreadsheet

Before I was using my current budget, the budget template I used was Pear Budget.

All of the instructions to use it are listed on the first tab of this template.

You really need to read through it first before using it to get the whole picture of how it works.

This isn’t to say that it is difficult to use, you just have to understand it in order to get maximum benefit from it.

Here is the link to access the budget.

#10. Microsoft Excel Spreadsheet Templates

If none of the above budget templates tickle your fancy, there is Microsoft itself.

They have over 100 free Excel budget spreadsheet templates to choose from.

If you can’t find one there, then I don’t know what to tell you!

Digital Budget Templates And Spreadsheets

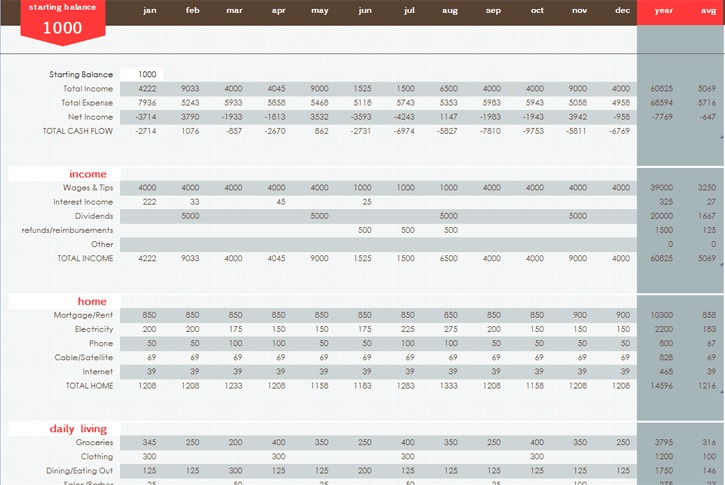

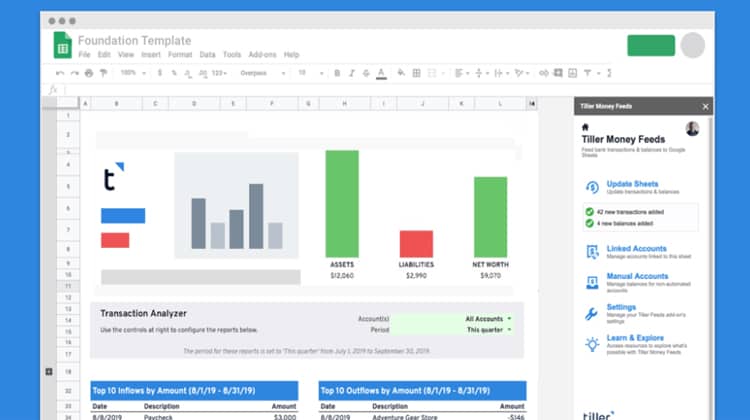

#11. Tiller Money Spreadsheet: The Best Budget Spreadsheet

My biggest gripe with budgeting had been finding one that did everything I wanted.

I tried automated services, but they never met my needs 100% of the time.

They were set up to use the way the developer wanted, not how I wanted.

So I switched over to Excel budget spreadsheet templates and created my own custom budget.

This worked great, but there was one downside. Time.

It wasn’t an issue before, but once I got married and had kids, manually entering everything into an Excel spreadsheet template took a lot of time.

But it was the best option I had.

That was until I stumbled upon something else.

It is called Tiller Money.

It is a hybrid spreadsheet budget and in my eyes, is far and away the best budget spreadsheet out there.

When you sign up, you pick from a pre-made budget that you can completely customize.

From there, Tiller automatically updates your transactions every day.

You have 100% control over the look and feel of the budget and the categories you want to track.

You can add graphs, create pivot tables, create new formulas, and more.

They simply pull the data for you to save time.

All you do is verify everything is correct.

I have to note that Tiller works off of Google Sheets and not Excel.

At first I was nervous but I’ve found Google Sheets to be a breeze to use.

And, I love how easily I can share the spreadsheet with my wife.

No more updating the spreadsheet budget, saving it to Dropbox, and having my wife go there to look at it.

With Tiller, my wife can easily access the budget anywhere she has an internet connection.

Coming from an Excel geek, I’ve found it amazingly useful and easy to use. It saves me so much time.

You can try Tiller is free for 30 days. I highly recommend you try it out.

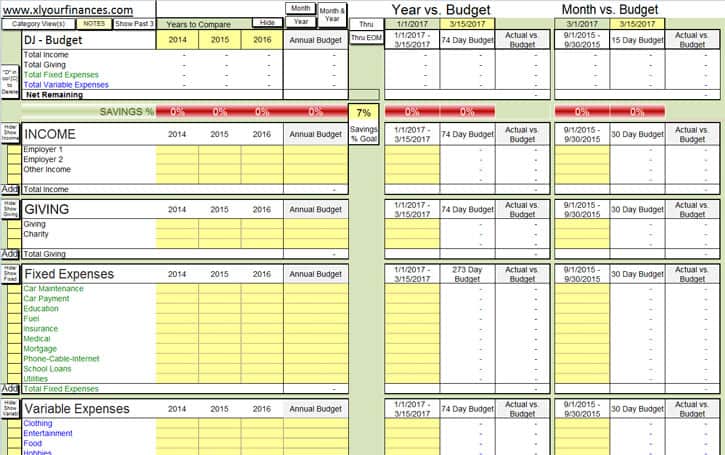

#12. XL Your Finances

Let’s say you like the idea of the Tiller spreadsheet above but you would rather it be in Excel.

Or maybe, you like some automation, but don’t want to give your banking and credit card passwords out.

Do you have any other options? You do!

It’s an Excel personal budget template download from XL Your Finances.

It is all set up for you, all you have to do is enter your transactions from your bank and credit cards.

It’s super easy to do this too.

Just download your statement in a .csv file and import it. Then with a little clean up, you have your budget.

It helps you with auto-labeling transactions, removing duplicate transactions, and offers a couple of reports.

By using this spreadsheet, you will save yourself a ton of time and many headaches.

You can see this spreadsheet in action by watching the video below

How much does it cost? That depends.

There is a free version that you can easily download and start using, but it requires manually entering your transactions.

If you opt for the paid version, it is only $19.99.

It’s a one-time charge and you get free upgrades for life.

You can access the paid version by clicking here.

#13. Personal Capital

This online tool allows you to track your spending and even highlight certain categories you want to keep a close on.

For example, maybe you tend to overspend dining out.

With Personal Capital, you can set it up so these variable expenses are front and center on the app to keep an eye on your spending.

Personal Capital is more than just a budgeting app too.

It also does an amazing job at helping you calculate your net worth, review your investments, and create a detailed and customized retirement plan for you.

While their budgeting feature isn’t the best when compared to the other free budget options on the list, you should still consider Personal Capital.

Why?

For the reasons I mentioned above.

By using Personal Capital, you get a detailed look at your investments and an investment plan to make sure you are investing for your age and goals.

Additionally, the retirement plan is priceless.

It is essentially the same thing we were charging customers for at the high net worth planning firm I worked at.

You can edit the details and it adjusts based on your investment balances. It is hands down the best thing out there.

And it’s 100% free to use!

You can click the link below to take complete control of your finances with Personal Capital.

#14. GoodBudget

GoodBudget is a virtual envelope budgeting system and it works great.

There are 2 versions of the app and the free version should be enough for most users.

With it you get one account that you can sync across multiple devices.

You get 10 regular budget envelopes and an additional 10 more.

There is no syncing to your bank account, so you need to manually add transactions.

The paid version allows you to have unlimited accounts and envelopes. You also get priority email support if you need it.

The cost of the GoodBudget Plus version is $5 a month or $45 is you pay annually.

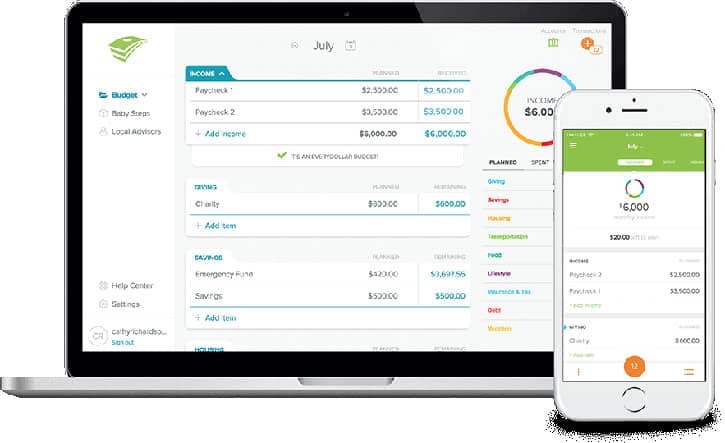

#15. EveryDollar

EveryDollar was born out of Dave Ramsey’s Lampo Licensing group to help people looking to get out of debt a simple budget solution.

And after trying it out, I must say that it is a great budgeting tool worth considering.

It has a super clean look and syncs across all your devices, so no matter where you are, you have access to an up to the minute budget.

There are two versions of EveryDollar.

The free version allows you to set up and follow a budget and manually add transactions.

The paid version, EveryDollar Plus, costs $99 a year.

By paying for the upgraded version, you get to link you bank accounts so you can monitor your balances and have transactions automatically added to your budget.

For most people, the free version is the way to go.

If you are thinking of the Plus version, I’ve recommend you first consider another free household budget template I’ve listed as you can get you what you need and don’t cost any money.

Here is the link to learn more about EveryDollar.

#16. You Need A Budget

You Need A Budget (YNAB) is one of the best budgeting apps out there.

They take the envelope budgeting process one step further by giving every dollar a job.

When I first tried out YNAB, I needed to watch many of their support videos to get the concept of how their budgeting process works.

In other words, this isn’t an option you can sit down with and have a budget made in 10 minutes.

It will take you time to understand how it works.

With that said, this is a powerful budget. Users swear by it and I can see why.

Once you get in the habit of their process, you will see a remarkable change to your finances.

It costs $84 a year but you can try it out for free for 34 days to see if you like it.

Even though this isn’t a free budget template, the $84 is well worth the cost if you want to see a change in your finances.

#17. Google Sheets

Just like with Microsoft Excel, you can use some pre-made budgets using Google Sheets.

In some ways, Sheets is more powerful and easier to navigate than Excel, which is why many people prefer to build an annual budget using this software.

Why I Don’t Recommend Mint

If you search online for the best budget templates, you are going to find a lot recommend Mint.

While there is zero cost to using this monthly budgeting app, I cannot recommend it.

There are various reasons for this.

First, and most importantly, is that it rarely works.

In the past, I’ve gone through the process of linking my accounts and setting up my budget only to find that they stop syncing.

It turns out Mint is losing the secure connection to my bank.

At first this was just an annoyance.

But then it happened more often to the point where I was spending all my time reconnecting my accounts and not on my budget.

And many others have this problem too.

Another reason is why it is free.

It is free to use, but Mint partners with other financial services companies to show you advertisements.

If you have debt, they will show you ads for refinancing your debt to lower your interest rate.

On the surface this sounds good, but Mint doesn’t personally vet each service it is showing you ads for.

In other words, you don’t know just how trustworthy they are unless you spend the time doing your own research.

As a result, I recommend you stay away from Mint and try the other free options I mention.

Final Thoughts

A budget is a key personal finance tool that help you not only see your financial health, but helps you improve it.

As a result, you need to find one that you will enjoy using and that you understand.

Since everyone is different, there are lots of free budget templates to choose from, including completely manual options and automated options.

As I mentioned in the post, I feel that Tiller Money is the absolute best budget spreadsheet out there.

The others listed are good as well, but Tiller does so much for you, saving you time, while still allowing you to completely customize your budget.

Of course, some of you may not want to pay for a monthly budget template.

If this is you, then the other options I listed are great choices.

If you are just starting out, I recommend a simple budget template like the ones I used at first.

They are easy to use and will get you in the habit of budgeting.

From there, you can choose a more detailed monthly budget worksheet that has more bells and whistles.

Why do I recommend this strategy?

If you opt for the detailed monthly budget worksheet to start, you might get overwhelmed and quit budgeting.

By keeping things simple at the start, you increase the likelihood of sticking with it long term and making budgeting your money a habit.

This will then open doors and opportunities as you build wealth.

I hope you found this round up of budget spreadsheets useful and found one that you can start using to budget your money.

Be sure to check back often as I am always updating this post with new free templates that I feel are worthy to be included.